HealthEco looks ahead. We anticipate emerging solutions and provide health system leaders with the insights to preemptively improve patient care and optimize health system efficiency for the future. This article explores how HealthEco works to improve healthcare investment and innovation for health systems.

Who We Are

With the ability, resources, and expertise to care for the sickest and most medically complex patients in the world, health systems serve unique functions to their local and global communities that are singular and indispensable. In practice, services that are essential to the protection of human life are not always profitable or efficient, and thus are not always maximized as the critical capabilities that they represent.

HealthEco seeks to amplify the areas where health systems already provide exceptional care. By focusing on a health system’s unique areas of excellence and expertise, we are able to leverage the scale of multiple health systems to improve patient care across a broader healthcare ecosystem and support health systems in doing what they do best – caring for those who need them.

Health system assets work to maximize the diversification of operations – but present market conditions make it increasingly difficult for healthcare leaders to assess the available opportunities for ancillary revenue. HealthEco partners with entrepreneurial-minded health systems to deliver symbiotic, innovative solutions across a collaborative healthcare ecosystem. Our health system partners are open to solutions of the future – but may not have the time, resources, or on-hand expertise to explore and de-risk all options. Luckily, we do.

HealthEco’s research team is agile, bright, and tenacious. Our team integrates seasoned industry expertise with an energized commitment to improve patient care – we coalesce to form the polymath creative, eager to adapt to a constantly fluctuating healthcare ecosystem.

What We Do

We dig deep. We seek solutions that scale, and we always have the bigger picture in mind – including how quickly that big picture can change. We adjust our vision with the times, but we know what to look for and our values are steadfast.

The HealthEco Research Team continuously monitors the healthcare landscape to identify opportunities that become areas of value for health systems. Relentless attention to detail lends us the insight to guide health system leaders to the right opportunity, with the right partners, at the right time. We conduct diligence processes and investigative research with analytical rigor and ecosystem familiarity to successfully de-risk investment opportunities and drive new margin gains for health system partners. Ultimately, HealthEco works to empower and enrich the providers that are already positioned to deliver patient care – health systems.

HealthEco’s due diligence and commercialization process curates opportunity analysis to guide health system leaders to profitable solutions and, ultimately, to optimize patient care and population health across the country. Our ability to synthesize high level insight from health system partners with critical and emerging multidisciplinary research allows us to anticipate and identify revolutionary models of care as they emerge. Exceptional core research strengths allow us to de-risk curated solutions according to individual health system profile and financial persona. Opportunities that reach commercialization have been thoroughly de-risked and supply all components necessary for healthcare stakeholders to commercialize and launch new businesses and revenue streams.

How We Do It

The HealthEco methodology for market analysis synthesizes market data with a careful assortment of interdisciplinary sources with the observations that we accrue through regular conversations with industry leaders and health system stakeholders. Over the course of this work, we accumulate a rounded and diverse vision of the healthcare ecosystem. Our unique positioning allows us to identify the conditions necessary for success in each specific market segment, as well as within the larger market landscape, with intuitive foresight.

Strategic Themes

HealthEco’s strategic themes represent emerging market areas that we have identified as either pivotal sites of investment activity across the market, or as potential areas of opportunity for health systems based on their unique persona and interests. Our analysis leads us to believe that the following segments will increasingly materialize as core sites of market opportunity for health systems as we move further into 2023 and 2024. Check back for in-depth analyses of the following strategic focus areas.

Student Health

The term “college student” represents a more diverse patient population than ever before. This is a cause for celebration, as gaps in education and barriers to access are removed. It is also an impetus for healthcare leaders to rethink how best to meet, treat, and empower this new student body. As the mental health of all Americans but, particularly, of young adults declines at an alarming rate, universities are largely underfunded, understaffed, and underprepared to provide adequate care to their student population.

Health systems would be well incentivized to consider how they can proactively respond to these challenges and support campus health services by collaborating with university partners. The health of college students represents a critical component of the healthcare infrastructure in the United States. Health systems with the capability and incentive to grow a comprehensive solution in this space will not only attain a net new population of possibly-lifelong system users; they will also gain access to invaluable data concerning the health status and care utilization of college-aged adults in their region. By collaborating with universities in the acute, non-acute, and consumer spaces, health systems can mitigate and address the challenges facing U.S. university students and improve the overall health outcomes of young adults.

Market Snapshot:

- CAGR: N/A

- Students demand a digital interface that facilitates quick turn-around for scheduling, virtual visits, test results, and consultations

- Students desire a combination of in-person and virtual services

- Speed and fluency of the technology build and interface are essential to successful student utilization

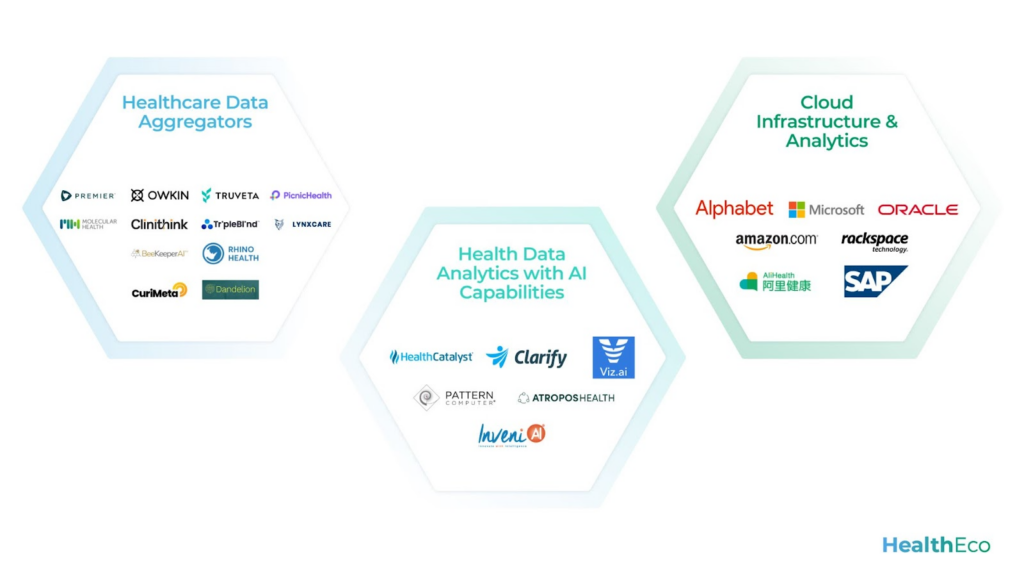

Data Commercialization

The mass entrance of technology partners into the healthcare industry has worked to normalize AI opportunities and encourage public sentiment to embrace machine learning, but risks still exist and business models remain largely unproven. As AI and machine learning tools transition from intangible buzzwords to executable business solutions, health systems will need to evolve data structure, governance, and leadership models if they wish to integrate and monetize new data solutions.

Data must be re-structured and standardized to run AI models effectively. The process of structuring and standardizing data requires skilled technology partners and a talented workforce, which can be expensive.

Health systems looking to commercialize or leverage patient data will need to approach any endeavor with thoughtfulness and internal alignment. If an AI initiative fails to receive executive buy-in, insufficient alignment will lead to low funding and limited pilots that reach commercialization.

Market Snapshot:

- CAGR (Healthcare AI): 32% through 2033

- CAGR (Database Storage): 17%

- The healthcare cloud market represents the potential revenue growth and overall market value for Software-as-a-service (SaaS), Infrastructure-as-a-service (Iaas), and Platform-as-a-service (Paas).

- SaaS companies represent roughly 63.7% of the overall market, with AWS owning 40% of the market and Microsoft owning 18%.

- The growth in the market demonstrates that health systems are looking to SaaS partners and others to provide infrastructure and analytics for increasingly complex data sets.

- Cloud facilities expand the capability of a health system to migrate multiple data sources onto a single platform, which is defined as data interoperability and data aggregation.

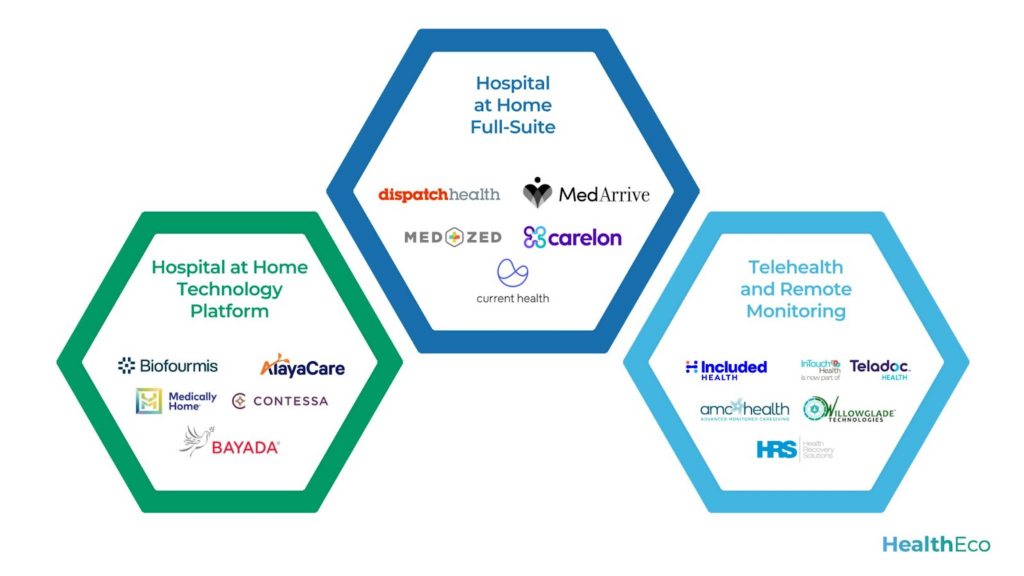

Hospital at Home

In recent years, and particularly in response to COVID 19, trends in home health care have created an opportunity for higher acuity patients to receive hospital-level care in their homes enabled by virtual remote monitoring. Expanded access to Medicare and Medicaid reimbursement under the Patient Protection and Affordable Care Act (PPACA) has continued to incent providers to transition the site of care towards the home, where patients can receive convenient, holistic care. As COVID 19 falls into hindsight and reimbursement statuses change, health systems are working to understand what role, if any, a hospital-at-home function should support in the patient care continuum.

Ambiguity surrounding commercial and government reimbursement is a major barrier to the execution of successful programs, and some health systems are wary that a hospital-at-home workforce would exacerbate existing staffing shortages by disrupting the pipeline of nurses willing to provide on-site care. Similarly, organizations boasting strong brand recognition are resistant to outsourcing patient-facing services to hospital-at-home platforms. Health system leaders wishing to pursue a hospital-at-home strategy must be prepared to educate and align internal stakeholders and providers with the hospital-at-home strategy, and its function in relation to the health system’s overarching mission and values.

Market Snapshot:

- CAGR: 36% through 2025

- Dispatch Health and Medically Home are front runners in funding and adoption for full-suite offerings

- Compared to other SaaS competitors, Medically Home is a clear market leader. All other competitors were initially focused only on low-acuity services.

- Not included here: Virtual primary care platforms & In-home senior care

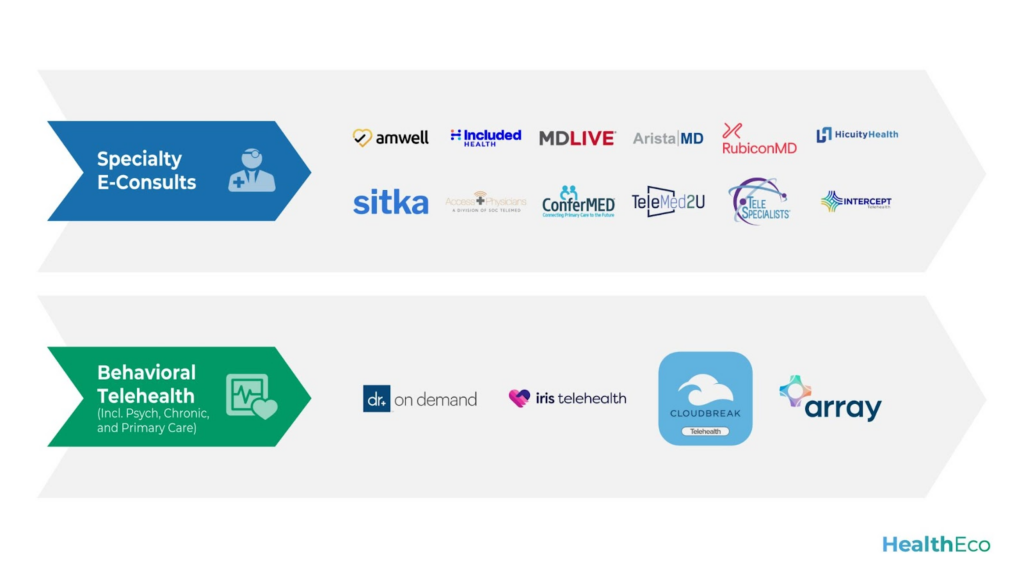

Virtual Acute Telehealth

Increased demand for acute telehealth services and recent market investments spotlight a continued interest in the telehealth industry with high expectations for adoptions over the next decade. The value of a telehealth program is not in volume of virtual visits, which forms the business foundation, but in the downstream referrals, patient satisfaction scores, workforce optimization, network fees, and protection against patient leakage. Therefore, the business model behind acute inpatient telehealth services requires substantial scale to compete with existing market incumbents.

Any health system looking to successfully commercialize acute inpatient telehealth services will need to capture significant market share from existing, well-funded competitors. It will be critical that the health system first carefully evaluate their product offering against that of their competitors to determine the most successful strategy for market entry.

Market Snapshot:

- CAGR: 32% through 2028

- E-consults market is robust with well-funded competitors equipped with specialty service offerings

- Several well-funded providers within the virtual low-acuity care hold significant market share.

- Virtual care companies with high adoption rates are universally struggling to transition from a growth to net income focus. Poor bottom line performance has forced investors to downgrade telehealth stock ratings.

- Behavioral telehealth providers Teledoc and Doctor On Demand represent a combined $747M in funding.

- Array, Iris. Telehealth, and Cloudbreak represent targeted, small cap telepsychiatry companies.

- MDLive ($2B) and Amwell ($1.7B) are leading in the specialty econsult space.

- MDLive: Mature urgent care, mental health, and primary care teams alleviate staffing shortages

- Amwell: Successfully integrates their platform into health systems as software while offering select services per the demand of the health system

Stay tuned for upcoming announcements and thought leadership pieces as we continue to drive innovation and growth in the healthcare ecosystem.

Contact us today to learn more about how HealthEco can help your health system diversify and thrive in the changing healthcare landscape.